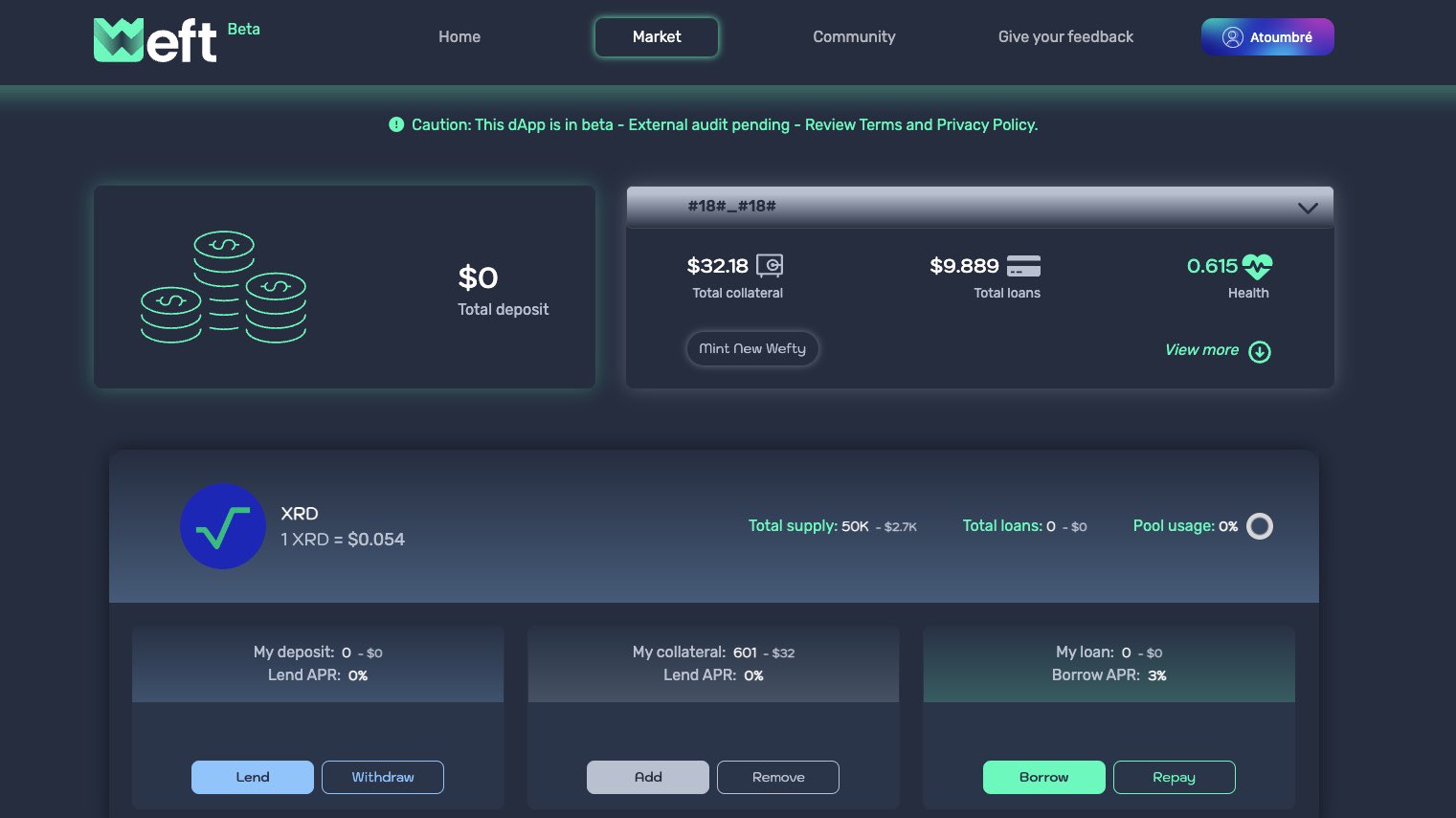

Weft Finance is a decentralized lending and borrowing platform built on Radix. At the heart of Weft lies the creation and management of collateralized debt positions (CDPs) represented by NFTs, known as ‘Wefties.’

History

Weft was founded by two Ivory Coast engineers, Yetinin Coulibaly and Atoumbré Kouassi. Living in different continents, with Coulibaly in Paris and Kouassi in Abidjan, they came together with a shared vision for financial innovation and economic development in Africa. Their collaboration began in 2021 when both became active members of the Radix Community. Despite having never met, the two engineers discovered a shared vision for the future and a strong alignment in values.

After meeting in person in Abidjan in fall 2022, they decided to form a partnership and build their first decentralized application (dApp) for lending and borrowing financial services. This led to the creation of Weft, aiming to harness the transformative potential of RadixDLT for the future of DeFi.

The platform is now developed by a team of seven individuals, collectively known as Weft'ers.

Features

Weft offers several key features to facilitate lending and borrowing of digital assets:

Lending Pools: Weft utilizes lending pools that hold assets deposited by lenders. Each pool is designated for a specific asset type. Lenders receive deposit units representing their share of the pool.

Loan Units: Borrowed amounts are tracked using loan units, which reflect a borrower's share of debt obligation. Interest accrual is handled through the loan unit system.

Interest Rate Strategies: Interest rates are set dynamically based on lending pool usage through predefined interest rate strategies. This allows rates to adapt to market conditions.

Borrowing Power Delegation: Users can delegate their borrowing power by minting a linked "delegated Weftie" NFT and sending it to another user. The recipient can then borrow without needing collateral.

Liquidations: Loans with insufficient collateral can be liquidated by external entities or automatically. This sells collateral to repay loans and brings loan-to-value ratios back into a healthy range.

User Positions Operations: Weft supports position modifications like collateral swaps and direct loan repayment using collateral ("self-liquidation").

The system is designed to be flexible, secure, and capture the nuances of each loan through use of the non-fungible Wefties.

Components

Weft Finance relies on several key components to enable its lending and borrowing functionality:

Lending Pools

Hold assets deposited by lenders and act as reserves for borrowers

Each pool is for a specific asset type (e.g. $XRD)

Mint deposit units to track lenders' shares

Manage accrued interest on loans

Provide flash loans

Lending Market

Acts as the interface between lenders/borrowers and lending pools

Handles borrowing, repaying loans, liquidations, withdrawals

Ensures security through badges and access rules

Validates and extends Wefties to enable pool interactions

Wefties

NFTs that contain users' collateral & loan positions

Secure metadata that stores deposit unit collateral amounts and loan unit borrowed amounts

Controls enforced by Lending Market badge

$WEFT Token

Last resort protection against market volatility risks

Stakers can deposit $WEFT to mitigate potential insolvencies

Stakers earn a portion of collected fees as insurance premiums

This modular architecture maximizes flexibility and security of lending operations.

Operations

Weft supports several key operations for lenders and borrowers:

Lending

Users contribute assets to lending pools

They receive deposit units representing pool shares

Deposit units can be redeemed for assets

Borrowing

Validates the Weftie NFT and extends it

Executes borrowing order through pool interactions

Performs health checks on loans and updates Weftie

Interest Accrual

Interest rates set dynamically based on pool usage

Accrued by increasing total borrowed amount

Deposit and loan units remain constant

Revenue

Collected from loan interest, flash loan fees, liquidation bonuses

Shared between operations costs and insurance module

Insurance Module

Accepts staked WEFT tokens

Tokens sold to cover losses in extreme situations

Stakers earn portion of revenue as insurance premium

Weft aims to make lending and borrowing as seamless as possible while keeping operations decentralized and secure.

Roadmap

Weft Finance has laid out a roadmap to drive the growth and adoption of its lending and borrowing platform:

Q3 2023

✅ Launched validator node, distributing $WEFT tokens to stakers

✅ Introduced Weft Alpha version on testnets for early feedback

Q4 2023

✅ Initiated $WEFT token listing and liquidity mining incentives

✅ Released Beta version on updated testnet after Babylon launch

✅ Started auditing Scrypto code prior to mainnet

✅ Launched mainnet MVP after completing audits

✅ Introduced Weft staking and early adopter incentives

2024

Planning interface upgrades and mobile app launch

Transitioning towards a DAO model by end of 2024

The roadmap focuses on iterative community-driven development, testing, and upgrades to eventually decentralize Weft into a DAO.

Team

Atoumbré Kouassi

With a Master's degree in Applied Statistics and Economy, Kouassi has had a successful career in support service management in Abidjan. A dedicated professional, Kouassi has been following and experimenting with blockchain technology since 2013. His search for an efficient distributed ledger technology led him to discover Radix DLT, which would become the foundation for Weft.

Yetinin Coulibaly

A master in Embedded Electronics and Industrial Computing, Coulibaly is a lead developer based in Paris. He has a strong entrepreneurial spirit, having instigated a Senegal-based startup that provided digital ticketing solutions for transportation and event sectors. Coulibaly's drive and interest in blockchain technology eventually led him to join the Radix Community and embark on the journey of co-founding Weft.

Zivile

Community Manager

Penifana

Frontend Developer

Roland

Backend Developer

Maxence

Project Manager

Amadou

PhD Advisor providing research guidance