CaviarNine is a comprehensive DeFi ecosystem offering a range of products and services. The CaviarNine suite of products is also referred to as the FLOOP DeFi Ecosystem after its native $FLOOP token.

Background

The platform is owned and operated by CaviarNine Limited BVI, a company incorporated in the British Virgin Islands. The CaviarNine ecosystem includes various services, such as The Aggregator and liquidity provisioning tools, developed by Caviar Labs, a Singapore registered software development house and subsidiary of Invariance Pte Limited.

Products

Aggregator

The Aggregator is a unified front-end gateway to all liquidity on the Radix network. Initially known as DSOR (Decentralised Smart Order Router), it has been revamped and rebranded under the CaviarNine umbrella. The Aggregator's primary function is to ensure traders get the best possible price by aggregating liquidity from various sources. It searches all known DeFi smart contracts for liquidity, ensuring users get the best trade across all liquidity sources on Radix. The Aggregator connects to DEXs, order books, token bridges, validators, and other liquidity sources, ensuring traders don't have to rely on a single DEX for the best price.

Fee Structure

A minimal fixed fee is charged by the Aggregator, which is waived when routing to any CaviarNine liquidity. All fees accrued are directed to the FLOOP Treasury, controlled by the FLOOP DAO. These fees can potentially be converted into $FLOOP and either burned or used for long-term liquidity rewards.

Index Pools

Index Pools are multi-token pools that allow for bespoke liquidity provision, each characterized by different constituents, weights, and risk profiles. Pools can comprise between 2 and 9 distinct tokens.

Fee Structure

Index Pools incorporate a minor fixed fee component along with a dynamic liquidity fee meaning that in volatile market scenarios, liquidity providers receive increased fees as a buffer against impermanent loss. Liquidity providers (LPs) receive a portion of the liquidity fee proceeds. As per FLOOP Tokenomics part 1, the fixed fees are directed to the FLOOP Treasury, which is overseen by the FLOOP DAO. These fees might be converted into FLOOP and either burned or allocated for extended liquidity rewards.

Order Book

Order Book is low-fee market and limit order system, which stands as an alternative to CaviarNine’s standard Automated Market Maker (AMMs). The Order Book also provides options for immediate execution or cancelation on partial fills. While Order Books allow traders to specify exact prices for transactions, they don't guarantee order fulfillment. AMMs, on the other hand, guarantee trade execution but can vary in price based on pool liquidity and trade size.

Fee Structure

A nominal fee is charged by the Order Book and directed to the FLOOP Treasury, which is overseen by the FLOOP DAO.

Shape Liquidity

Shape Liquidity is an Automatic Market Maker (AMM) that allows liquidity providers (LPs) to focus their positions on active trading zones within specific price ranges, using a variety of concentrations. This is more capital efficient and enables LPs to generate higher fees from their available capital.

Shape Liquidity provides various shapes for liquidity concentration, such as:

Constant Height Range: Maintains a steady concentration of liquidity over the desired price range.

Center-Peaked Curve: Liquidity peaks at the center of the range and tapers off towards the edges.

Bar-Bell Shape: Ideal for providers who anticipate significant trading activity around two specific regions.

Fee Structure

Shape Liquidity features both a fixed fee and a dynamic liquidity fee that auto-compounds to the underlying position, acting as a cushion against impermanent loss. Liquidity providers share the proceeds of the liquidity fee, while fixed fees are sent to the FLOOP Treasury.

LSU Pool

The LSU Pool is a multi-token pool for Radix’s Liquid Staking Units (LSUs) that represent shares of the staking pool. Each LSU is associated with specific validators, who may offer bespoke rewards for staking with them. The LSU Pool offers multiple ways for users to utilize their LSU tokens, such as moving between validators, facilitating Instant Unstaking, and providing additional yield to LSU Pool liquidity providers.

Instant XRD Unstaking allows users to send an LSU and receive XRD instantly, albeit at a slightly reduced amount compared to waiting the standard 7-day unstaking period. This feature provides flexibility and immediate liquidity to users.

Fee Structure

In line with FLOOP Tokenomics part 1, fixed fees are directed to the FLOOP Treasury, controlled by the FLOOP DAO.

Perpetual $XRD

Perpetual XRD (pXRD), is a Market-Driven Liquid Staking Derivative on Radix. Initially set at a 1:1 ratio with XRD, pXRD's future price is determined by an on-chain oracle that takes into account the yields of active validators. This ensures that pXRD's growth rate is in line with the performance of top-tier validators. Users can deposit eligible collateral into a vault, and pXRD is automatically minted against it. They can receive up to 95% of the value of their collateral as pXRD. The system offers high leverage opportunities due to the low volatility of pXRD and its eligible collateral. If the eligible collateral drops below a certain threshold (e.g., 102% of the pXRD value), liquidation occurs. Anyone can claim the collateral by supplying pXRD and earn the difference.

The main types of collateral include XRD (Radix's native token), LSUs (any validator token), LSU-NFTs (claim token receipts obtained after unstaking from a validator), and LSU-LP (Liquidity Pool tokens from CaviarNine's LSU Pool).

The consistent increase in Perpetual XRD's price offers a systematic, yield-based valuation process, eliminating sudden price-driven liquidations.

Users can earn above-average yields, unlock the potential of their XRD, and benefit from a staked XRD derivative designed for DeFi protocols. The system also offers arbitrage opportunities and charges a nominal protocol fee.

Perpetual XRD is perfect for those seeking stable growth, risk managers, and yield hunters.

Fee Structure

Similar to FLOOP Tokenomics part 1, the protocol fees are directed to the CAVIAR Treasury, which is overseen by the CAVIAR DAO.

Radit

Radit.io was an on-chain messaging service but has been discontinued.

Team

The CaviarNine team is diverse and spread across Thailand, Singapore, Canada, and Australia, with its headquarters in Bangkok. The founders, Oliver Scott Simons (aka Tronn) and Chris Colman, have extensive backgrounds in finance and technology. Their mission is to provide users with seamless access to professional-grade innovative DeFi products and unlock the full potential of DeFi.

Tokens

CaviarNine has introduced two primary tokens: $FLOOP and $CAVIAR. These tokens are associated with the platform's DeFi products and serve as utility and DAO tokens. They were minted prior to the Babylon upgrade and the start of dApps on Radix. Holders of these legacy tokens can bridge them to the Babylon versions that power CaviarNine's products.

Floop ($FLOOP)

Babylon $FLOOP tokens will power the expanding ecosystem and serve as governance tokens for the nascent FLOOP DAO. Users will have the option to transition their existing Olympia $FLOOP into Babylon FLOOP via a one-way bridge.

Distribution

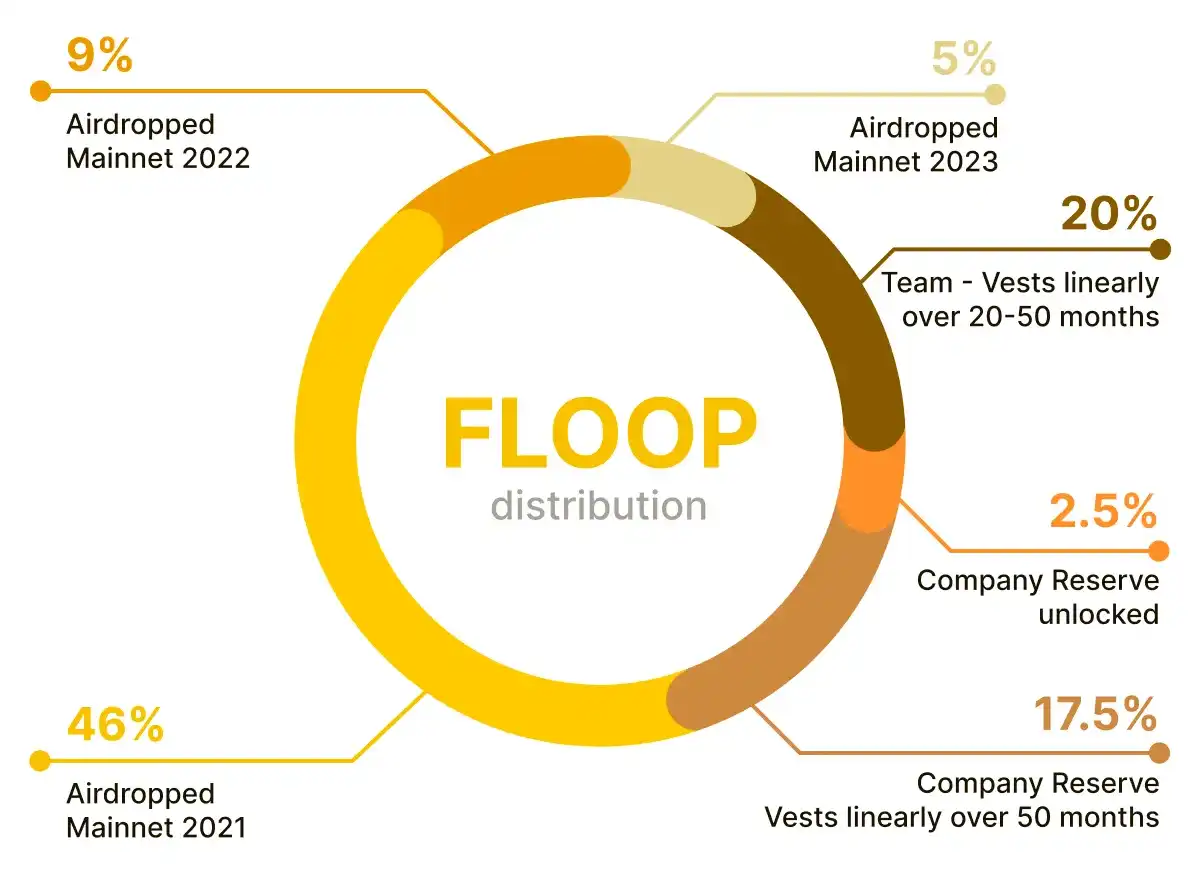

Around 55% of the original $FLOOP tokens were distributed via airdrops. Following the Babylon upgrade, the distribution of the original $FLOOP tokens is anticipated as follows:

Core Team: 200 FLOOP (20%)

Company Reserve: 200 FLOOP (20%)

Airdrops to LPs active within the FLOOP ecosystem (5%)

Caviar ($CAVIAR)

Babylon $CAVIAR, akin to $FLOOP, will be a newly bridged token that will power future DeFi structured products that CaviarNine intends to develop.

FLOOP DAO

The FLOOP Decentralized Autonomous Organization (DAO) is the cornerstone of the vision for a decentralized and community-driven ecosystem. Babylon $FLOOP tokens will be the backbone of the DAO, enabling decentralized decision-making that shapes the ecosystem's direction.